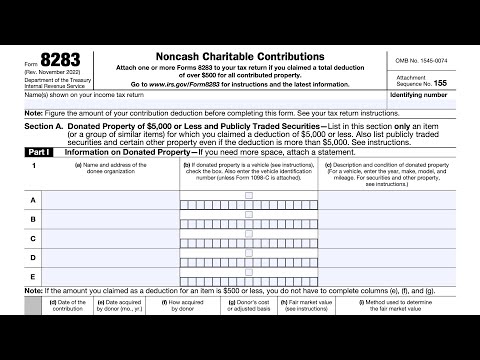

We'll be going over IRS form 8283 non-cash charitable contributions this two-page tax form contains two sections section A is for donated property of five thousand dollars or less in publicly traded securities section B is for donated property over five thousand dollars except for publicly traded Securities Vehicles intellectual property or inventory that's otherwise reportable in section A you must file IRS form 8283 if the amount of your tax deduction for each non-cash contribution is more than five hundred dollars you must also file this form if you have a group of similar items for which a total deduction of over five hundred dollars is claimed you should use this form to complete to report information about non-cash charitable contributions but do not use this forum to report out-of-pocket expenses for volunteer work or amounts that you gave by check or credit card you should treat those items as cash contributions do not use form 8283 to calculate your charitable contribution deduction instead see your tax return instructions and IRS publication 526. you should file form 8283 with your tax return for the year that you contribute the property and first claim a deduction and any carryover year as described in our Internal Revenue code section 170d if you must file 82 form 8283 you must complete either section A or section B depending on the type of property donated and the amount claimed as a deduction use section A to report donations of property for which you claimed a deduction of five thousand dollars or less per item or a group of similar items also use section A to report donations of publicly traded Securities certain intellectual property a qualified vehicle for which an acknowledgment under Internal Revenue code section 170f is provided and inventory and other...

Award-winning PDF software

How to prepare Form Instructions 8283

About Form Instructions 8283

Form Instructions 8283 is a document provided by the Internal Revenue Service (IRS) in the United States. It is a form used by taxpayers to report and claim deductions for charitable contributions. This form is used to declare the value of the non-cash charitable donations made by individuals or businesses. Individuals and businesses who donate non-cash property, such as clothing, furniture, artwork, or vehicles, to a qualified charitable organization must file Form Instructions 8283 with their tax return if the fair market value of the donated items is more than $500. Taxpayers should complete this form to substantiate their charitable contributions and to comply with IRS regulations. This form helps the IRS ensure that charitable deductions claimed by taxpayers are legitimate and are not overvalued, thus preventing tax fraud. The instructions guide taxpayers on how to fill out Form 8283 and provide detailed information on how to determine the fair market value of donated property.

What Is 2025 8283?

Online technologies make it easier to organize your document management and raise the productiveness of your workflow. Observe the short guide in order to fill out Form 2025 8283, keep away from errors and furnish it in a timely way:

How to complete a 8283?

-

On the website containing the document, choose Start Now and go to the editor.

-

Use the clues to fill out the applicable fields.

-

Include your individual information and contact data.

-

Make certain that you enter true details and numbers in correct fields.

-

Carefully revise the content of your blank as well as grammar and spelling.

-

Refer to Help section should you have any concerns or contact our Support staff.

-

Put an digital signature on your Form 2025 8283 printable using the help of Sign Tool.

-

Once document is done, click Done.

-

Distribute the ready document via electronic mail or fax, print it out or download on your device.

PDF editor enables you to make alterations on your Form 2025 8283 Fill Online from any internet linked device, customize it according to your requirements, sign it electronically and distribute in several approaches.

What people say about us

How to fill in templates without having mistakes

Video instructions and help with filling out and completing Form Instructions 8283